The company brings together, in a single architecture, all processes related to the issuance, placement, custody, governance, and taxation of private assets, offering banks, intermediaries, institutional investors, and companies a fully compliant and scalable end-to-end operating model.

ClubDeal Digital is evolving and rebranding as Weltix, marking the launch of the first Private Assets Operating System—a regulated FinTech infrastructure enabling transparent, efficient, and fully digital private asset management (as stated in the official press release).

The subsidiary ClubDeal Spa, a fintech platform simplifying private asset management founded by CEO Antonio Chiarello, integrates—thanks to its three regulatory authorizations from Consob, the Bank of Italy, and MIMIT (Ministry for Business and Made in Italy)—all processes related to issuance, placement, custody, governance, and taxation of private assets into a single unified system.

This provides banks, intermediaries, institutional investors, and companies with a scalable, fully compliant operating model.

Weltix is not just another digital platform.

It is the infrastructure that connects every player in the private assets value chain, enabling the digitalization of processes and the secure circulation of financial instruments.

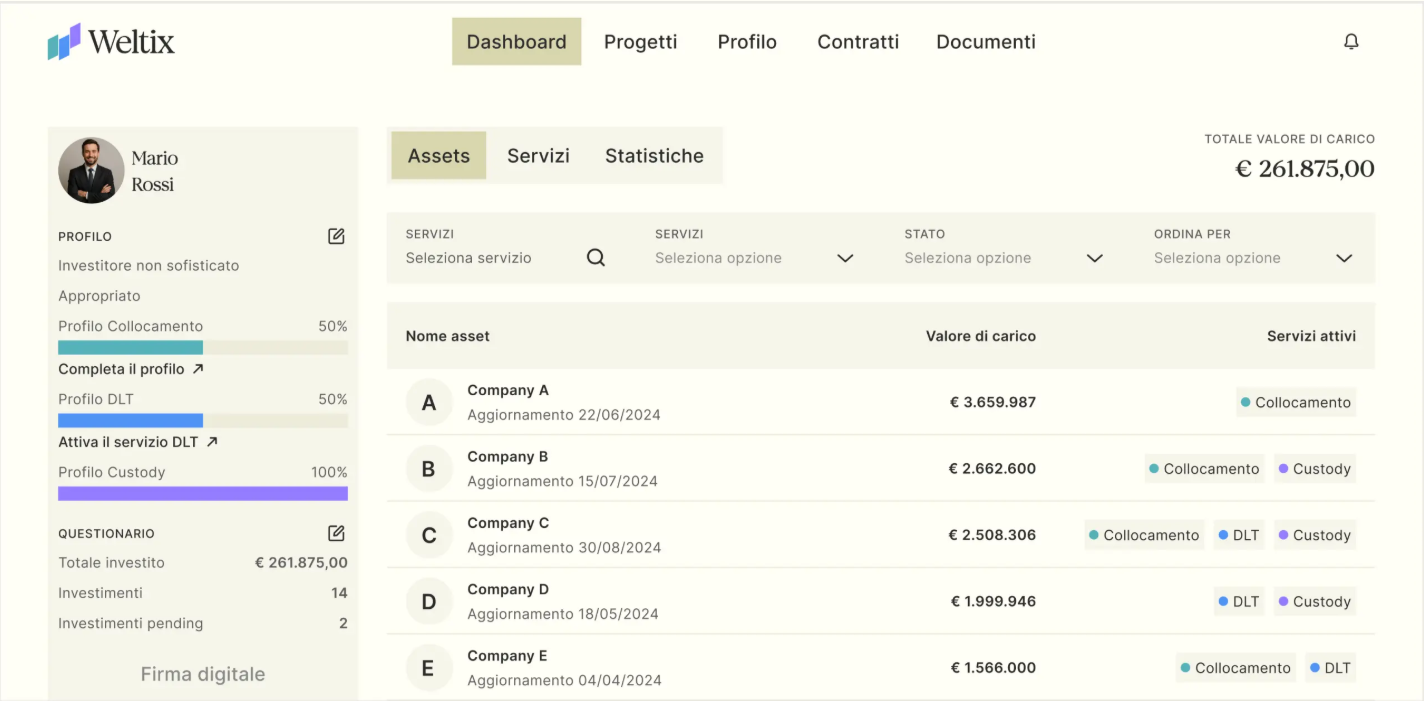

In practice, Weltix introduces a new level of efficiency in the management of shares, units, minibonds, securitized instruments, and employee share plans, integrating fiduciary and tax workflows in a fully automated way. Operators can concentrate on the strategic value of their work while Weltix manages operational complexity.

Weltix operates through a proprietary technological platform that already supports over 110 issuing companies across seven geographies—Europe, North America, and Asia—managing the assets of more than 16,000 private and institutional clients.

The platform covers multiple business lines: digital issuance and DLT registry services; regulated placement (Reg. EU 2020/1503); and integrated fiduciary and tax custody.

“We’re not building another platform—we’re building the operating system that supports new service models for private asset management.

Weltix is where compliance, technology, and execution meet—an infrastructure that enables banks and intermediaries to turn the promise of private assets into reality.”

Antonio Chiarello, Founder & CEO of Weltix Spa

Roberto Ferrari, President of Weltix, added:

“With Weltix, private asset management finally becomes simple, transparent, and traceable.

It is a concrete step forward in bringing innovation and trust to the real economy.”

Last September, ClubDeal announced the launch of its share tokenization initiative, making it the first Italian company to transform its share capital into financial instruments registered on a public blockchain, fully equivalent to traditional securities (see BeBeez).

The tokenized shares are recorded in the digital register managed directly by ClubDeal Spa in its role as DLT Registry Operator, as defined by the 2023 FinTech Decree.

Last July, ClubDeal obtained authorization to act as DLT registry service provider for the circulation of digital financial instruments (see press release).

The new license allows ClubDeal Digital to manage the issuance, registration, and transfer of tokenized financial instruments using blockchain technology, leveraging its platform which already includes digital onboarding, AML/KYC compliance, and fiduciary administration services.

It is worth recalling that ClubDeal Spa is the parent company of Weltix, as well as of the ClubDealOnline.comcrowdfunding platform, dedicated to HNWIs, family offices, and institutional investors in private assets.

Founded in 2017, ClubDeal Spa remains controlled by founder Antonio Chiarello (formerly Chief Investment Officer of Neva Finventures of Intesa Sanpaolo and key contributor to the launch of the Neva First fund). Over the years, several investors have joined the company.

The most recent round—announced in October 2023—involved €1.5 million, subscribed by the Fondo Rilancio Startup, managed by CDP Venture Capital SGR, along with other notable investors.

The operation valued the company at €18 million and was executed through convertible participating financial instruments.

Article on BeBeez

Leave a Reply