For the first time, an Italian company has tokenized its own shares on a public blockchain, taking advantage of the framework introduced in 2023 with the FinTech Decree.

The tokenized shares are fully equivalent, from a legal standpoint, to traditional paper-based instruments.

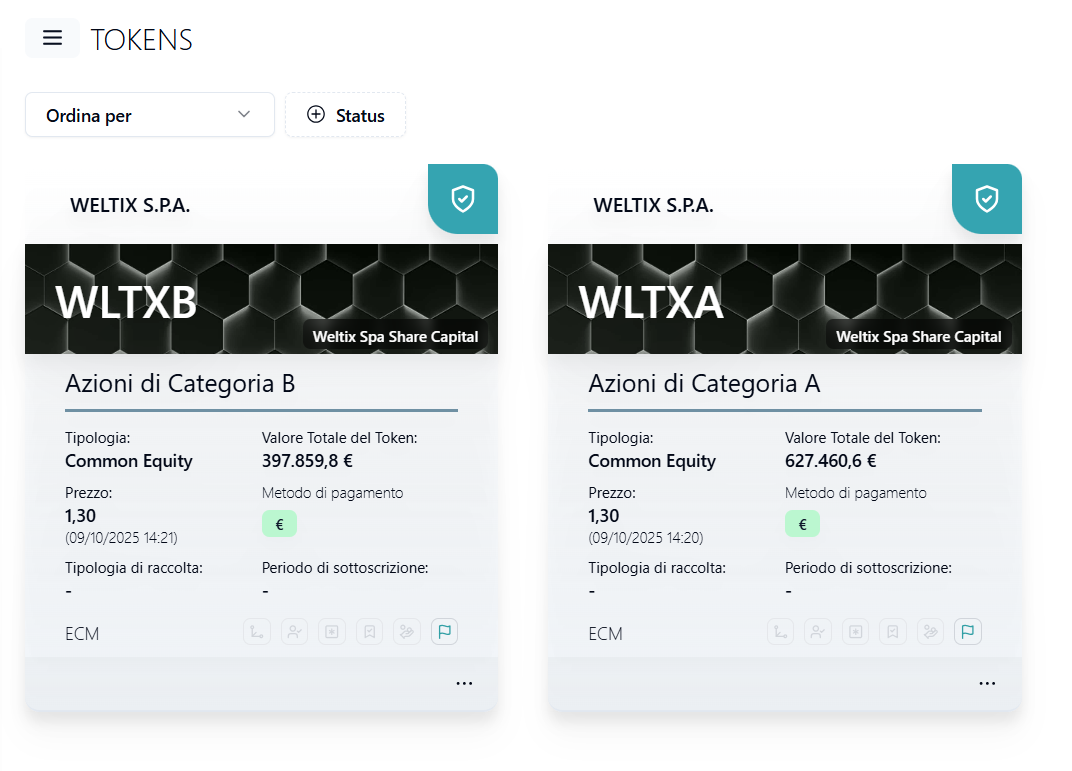

Weltix S.p.A.—a Consob- and Bank of Italy-authorized fintech platform simplifying private asset management—announces the launch of its share tokenization process, becoming the first Italian company to transform its share capital into financial instruments registered on a public blockchain and fully recognized as traditional securities.

The tokenized shares will be recorded in the digital register managed directly by Weltix in its role as DLT Registry Operator, in accordance with the FinTech Decree (D.L. 25/2023).

The tokenization of Weltix S.p.A.’s shares was carried out using a technological infrastructure developed with partner BlockInvest, based on the Polygon PoS public blockchain.

This infrastructure makes it possible to:

- Assign full legal value to the tokenized asset, replacing traditional paper-based formats under current regulations.

- Ensure transparency and immutability of corporate record-keeping.

- Simplify the management of the shareholder base, with secure and traceable digital transfers.

- Reduce the number of intermediaries required for the issuance and transfer of financial instruments.

This marks an important step forward for the future of the private markets: much like the transition from paper certificates to dematerialized securities, this new paradigm represents an evolution in how all market participants can interact with financial instruments—unlocking benefits across the entire value chain.

The tokenization of Weltix’s shares is the first practical application of the new service launched by Weltix last July for blockchain-based private asset management.

The service is designed primarily for banks, asset management companies (SGR), investment firms (SIM), and institutional investors, and leverages blockchain technology for the issuance, registration, and transfer of tokenized financial instruments—including company shares, corporate bonds and notes, participatory financial instruments, and securitized products.

Leave a Reply